VM Building Society (VMBS) has launched the VMBS Realtor Mortgage Advantage, a tailored mortgage offer designed specifically for licensed realtors in Jamaica, including first-time homebuyers and property investors.

The initiative responds to the unique income realities of this group of professionals and aims to strengthen access to homeownership and property investment within the real estate ecosystem.

The VMBS Realtor Mortgage Advantage features flexible repayment options, including monthly and quarterly schedules, pre-payments, and principal payment structures which are more aligned to commission income cycles. Eligible applicants may access up to 100% financing through a special qualifying pathway for first-time home buyers, while financing for investment and additional properties is available at up to 85% loan-to-value (LTV).

To further support uptake, VMBS is offering a special loan processing fee of 1.5% until June 30, 2026. Applicants under the programme will also benefit from special interest rates and faster processing, with dedicated routing to ensure timely review and feedback.

According to Latoya Williams, Assistant Vice President for Lending Solutions and Business Services, the programme is a deliberate response to a long-standing gap in the market. “Licensed realtors play a critical role in enabling homeownership and property investment across Jamaica, yet many face challenges accessing traditional mortgage financing due to the variable and commission-based nature of their income. The Realtor Mortgage Advantage is specifically designed to accommodate non-traditional income schedules while maintaining our credit discipline,” Williams said.

She added that the initiative reflects VMBS’ broader strategic objectives of strengthening partnerships within the real estate community, positioning VMBS as a preferred lender and long-term financial partner to realtors. It also builds on VMBS’ longstanding relationship with the realtor community, which began officially in 2017 with the establishment of the annual Win with VM referral programme, providing realtors with special commission for referring clients to VMBS for mortgage financing.

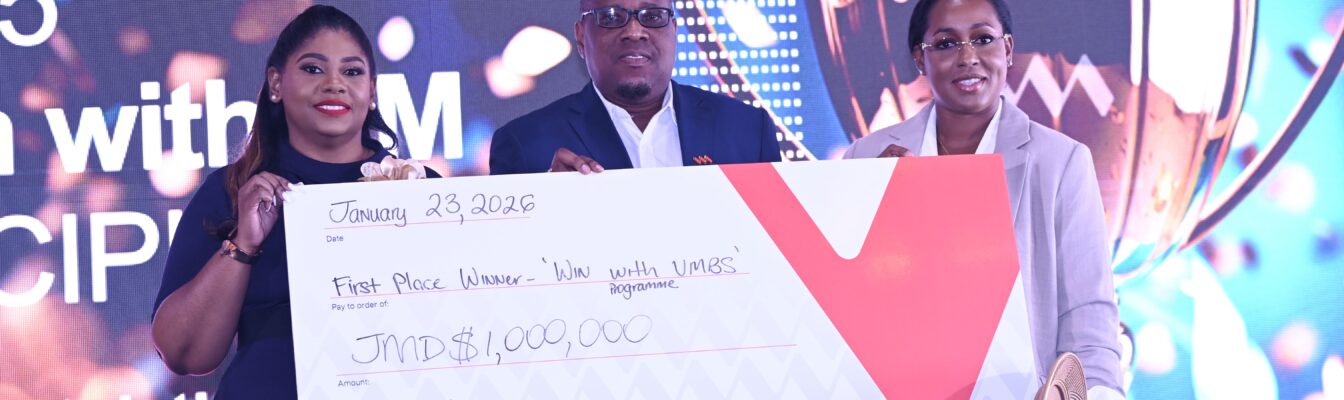

The Realtor Mortgage Advantage programme was officially launched during a VMBS Realtors’ Brunch on Friday, January 23, 2026, where the Society also awarded the winners and runners-up in the 2025 instalment of Win with VM, recognising top-performing realtors for their continued partnership and impact.

Realtors Teresa Wilson, Shion Waisome and Omroy Salmon were awarded first, second, and third place, respectively, for their performance. They walked away with cash prizes of JMD $1,000,000, $600,000 and $400,000.

Licensed realtors are encouraged to contact VMBS to learn more about eligibility and application requirements for the mortgage advantage programme.

Comments