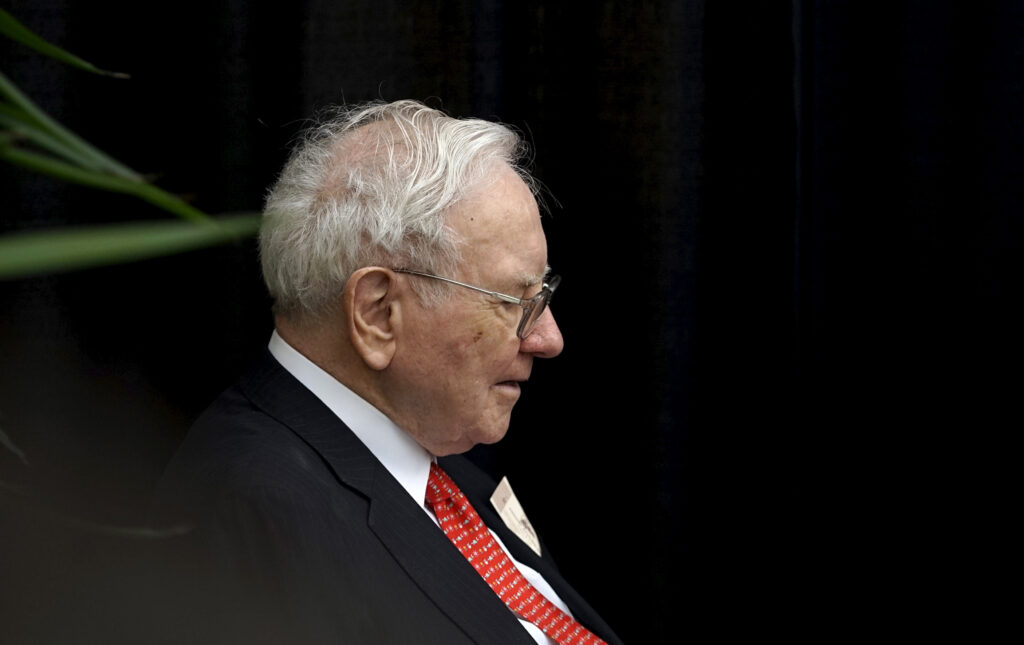

Chairman of Berkshire Hathaway, Warren Buffett, is causing consternation in financial markets with his decision to sell his stock holdings in some of America’s biggest banking houses.

More notably, this year alone he has sold US$3.2 billion in banking industry shares, including those from CitiGroup, Capital One and Bank of America.

This is perplexing because only last week, Our Today reported Citigroup’s profits leapt by 25 per cent and Goldman Sachs saw an uptick of 23 per cent. JP Morgan earned $15 billion for the second quarter, with its stock gaining about 20 per cent this year. Wells Fargo reported a profit of US$5.5 billion, up 12 per cent from last year.

Right now, Berkshire Hathaway is sitting on a pile of US$350 billion in cash, the highest it has ever held. Is this in anticipation of a major event rocking the US economy? Buffett made sure to stockpile cash just before the financial meltdown in 2008 and again during the COVID pandemic. What is he seeing now?

The US economy is slowing, but the S&P is rising. Is Buffett predicting a market correction?

Last year, he said in a CNBC interview, “I do think banking can get in a lot of trouble just because of the kind of thing that they did. I don’t like the banking business like I did before.

“Banks can take a lot of loan losses but they can’t take something that wipes out their capital and expect the world to ignore that fact. I just think the system isn’t set up quite right in terms of connecting punishment to culprit on something that’s important. It’s important that your banking system runs well in the country. The country doesn’t work well unless you have a banking system that works. You don’t want banks to create periodic crises unnecessarily.”

Is he recalling the crisis of 2008 and saying it was of the banking system’s making, and it did not pay a price for its folly but rather got a bailout? Does he see history repeating itself?

The US economy is not in terrible shape, but there are warning signs that Warren Buffett would have noted. Inflation is now at 2.7 per cent, and the GDP growth forecast is just 1.4 per cent. The Federal Reserve has put a hold on lowering interest rates with Fed Chair Jerome Powell saying, “In effect, we went on hold when we saw the size of tariffs and essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs.”

Household debt for the first quarter has skyrocketed to US$18.20 trillion, US$167 billion more than the previous quarter. The Big Beautiful Tax Bill is expected to increase the deficit by nearly US$3.3 trillion from 2025 to 2034.

Add to this war in Europe and conflicts in the Middle East, and there is much uncertainty. Buffett is being cautious. Aggressive tariffs are a central part of the American economic plan, and under President Trump, some see this as problematic.

President Trump’s tariff announcement in April saw the S&P 500 report US$5 trillion in losses in just two days.

Citi’s Chief Financial Officer Mark Mason observed: “The impact of tariffs and how that might show up in inflation and what some of the other unintended consequences might be is still unknown.”

Then there is the currency, the US dollar has fallen 10 per cent since the start of the year. Buffett once said: “We wouldn’t want to be owning anything in a currency that was going to hell. That’s the big thing we worry about with the United States. The value of currency is a scary thing.”

In 2004, still on the currency, the Chairman of Berkshire Hathaway wrote: “ We think over time that the dollar is likely to decline in value against some of the major currencies. This is not a short-term prediction.

“We’ve got a lot of problems always as a country, but this is one we bring on ourselves…. If you picked a way to screw it up, it would involve the currency. Right now, we have a 7 per cent fiscal gap when probably only 3 per cent is sustainable. The further we stray from sustainability, the closer we get to losing control.”

Does Buffett see the US in 2025 straying from sustainability? With BRICS gaining ascendancy and with many countries contemplating ditching the US dollar as the premier currency what, will the banking sector look like?

Less than two years ago, the disparities between traditional US banks and non-banking financial institutions caused alarm. Then there was the banks’ exposure to the cryptocurrency market.

With American banks increasingly lending to private credit, it opens them up to new channels of risk. More and more assets are being moved off the balance sheet.

Buffett has seen this movie before.

Comments