Exxon says the profits were a vindication of the firm’s strategy

The White House is describing as ‘outrageous’ the record US$55.7 billion (£45.2bn) windfall profit reaped last year by oil American multinational oil and gas corporation, ExxonMobil, as oil prices surged following Russia’s invasion of Ukraine.

The BBC is reporting today that this total was more than double 2021’s figure, and is likely to renew pressure on the industry after some countries, including the UK, imposed special taxes on the profits last year with Exxon criticising such measures as counter-productive.

Last month, Exxon sued the European Union over the new windfall tax. The American oil and gas major is speaking out against similar proposals in the United States, where President Joe Biden has sought to focus blame for last year’s high motor fuel costs on companies failing to spend their profits to boost supply.

White House issues statement

In a statement yesterday, the White House said it is “outrageous that Exxon has posted a new record for Western oil company profits after the American people were forced to pay such high prices at the pump amidst [Russian President Vladimir] Putin’s invasion”.

According to White House spokesman, Abdullah Hasan, “the latest earnings reports make clear that oil companies have everything they need, including record profits and thousands of unused but approved permits, to increase production, but they’re instead choosing to plough those profits into padding the pockets of executives and shareholders”.

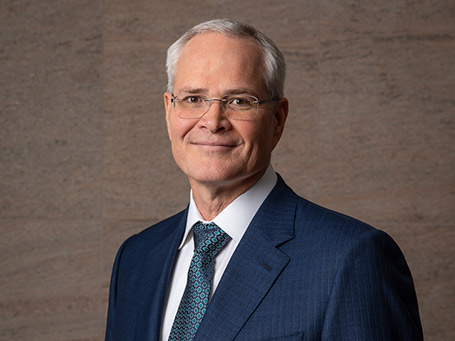

In a quick response, Exxon boss Darren Woods told CNBC that the White House needed to “get its facts straight”, noting that the firm had continued to spend money on oil and gas projects despite pressure from investors and others to shift investments to renewable energy. He told investors on Tuesday that the profits were a vindication of the firm’s strategy.

He admitted that the current environment played a role in this, saying “of course our results clearly benefited from a favourable market but, to take full advantage of the undersupplied market, our work began years ago”.

Speaking in a conference call with investors, Woods remarked: “We leaned in when others leaned out, bucking conventional wisdom.”

Exxon’s shares sank sharply in 2020, when demand for oil tumbled, leading the firm to report its first loss in decades. But the price of the shares has soared since 2021, especially since oil prices jumped when the war in Ukraine disrupted energy supplies last year.

Exxon took US$1.3-billion hit

The firm said it had been working hard to reduce costs, and profits would have been even higher without the windfall taxes in Europe admitting that it took a US$1.3-billion hit during the final months of 2022, mainly from extra European taxes. In addition, the oil major reported a US$3.4 billion charge for the year stemming from the expropriation of its investments in Russia.

Exxon said it increased investment by about 38 per cent last year.

In some key areas, such as Guyana and the Permian Basin, production was up more than 30 per cent, offsetting output lost due to divestments and the change in Russia. The company said overall oil production increased about three per cent in 2022, “to 2,354 thousands of barrels per day from 2,289 thousands of barrels per day in 2021”.

Comments