· Finance Minister Imbert gives the parameters for property tax

Trinidad and Tobago is targeting property taxes in its current fiscal year (FY 2022), as a significant revenue stream.

Currently no property tax is being collected with focus being placed on valuation rolls. All property owners are required to file an annual property tax valuation form with a deadline of November 30.

To date 127,969 property owners and occupiers have submitted return forms, which is below the 50% threshold, Finance Minister, Colm Imbert has established for each category of property to commence collections.

The property tax levy is a prescribed percentage of the Annual Taxable Value of the respective properties at the following rates: Residential (3%); Commercial (5%); Industrial with building (6%); Industrial without building (3%) and Agricultural (1%).

The Annual Taxable Value (ATV) is the Annual Rental Value at which a property will let from year to year after a deduction of 10% for Voids. All properties in Trinidad and Tobago are deemed to have a rental value.

Rental value calculation for property tax

The rental value is a calculation of the rent the property will obtain on the open market (if it were put up for rent). For persons, who own properties which would rent for TT$3,000, the property tax would around TT$80 to TT$90 monthly.

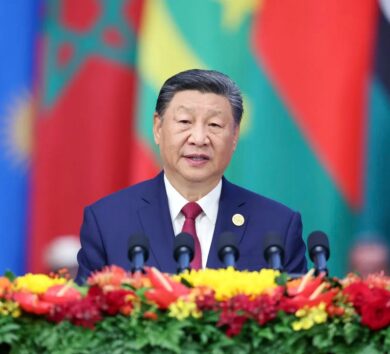

For those persons who own properties which would rent for TT$10,000, the tax would be TT$250 monthly. Minister Imbert gave the parameters for property tax, as he piloted the Appropriation Bill in the Senate at the Red House in Port of Spain recently.

Imbert explained that the valuation division of his ministry was gathering information for property tax.

The Finance Minister added that the property tax roll would have a description of the properties, location, age, size, etc. and that it had to be populated with 50% of the number of properties in any given category whether it is residential, commercial, agricultural.

Comments