TD Bank NA (TDBNA)—the 10th largest bank in the United States—and its parent company TD Bank US Holding Company (TDBUSH) pleaded guilty on October 10 and agreed to pay over $1.8 billion in penalties to resolve the Justice Department’s investigation into violations of the Bank Secrecy Act (BSA) and money laundering.

TDBNA pleaded guilty to conspiring to fail to maintain an anti-money laundering (AML) programme that complies with the BSA, conspiracy to fail to file accurate Currency Transaction Reports (CTRs), and conspiracy to launder money. TDBUSH pleaded guilty to causing TDBNA to fail to maintain an AML programme that complies with the BSA and to fail to file accurate CTRs.

TD Bank’s guilty pleas are part of a coordinated resolution with the Board of Governors of the Federal Reserve Board (FRB), as well as the Treasury Department’s Office of the Comptroller of the Currency (OCC) and Financial Crimes Enforcement Network (FinCEN).

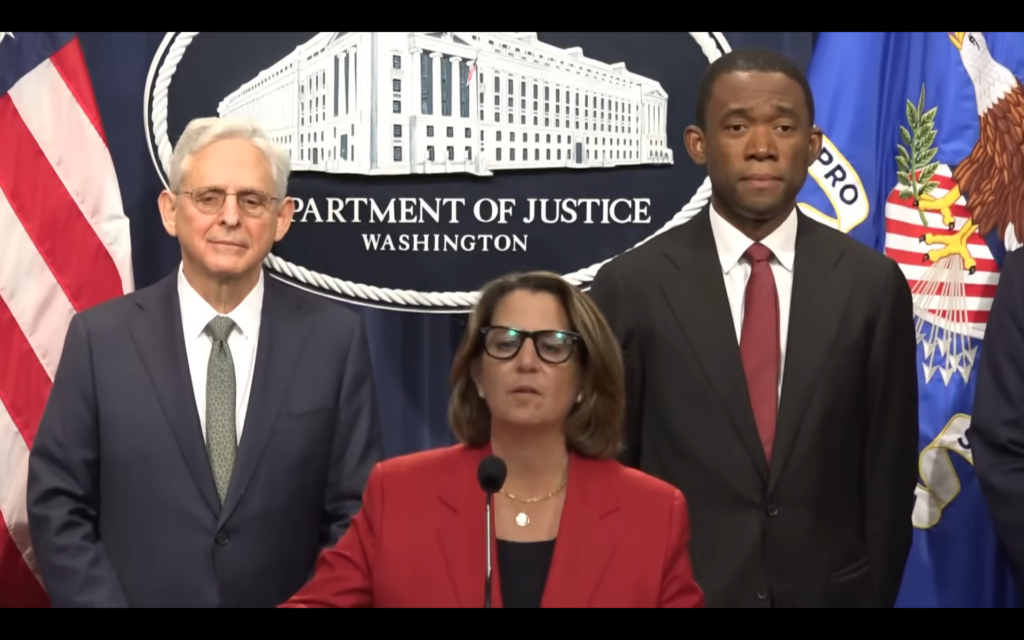

“By making its services convenient for criminals, TD Bank became one,” said Attorney General Merrick B Garland. “…TD Bank also became the largest bank in US history to plead guilty to Bank Secrecy Act programme failures, and the first US bank in history to plead guilty to conspiracy to commit money laundering. TD Bank chose profits over compliance with the law—a decision that is now costing the bank billions of dollars in penalties. Let me be clear: our investigation continues, and no individual involved in TD Bank’s illegal conduct is off limits.”

Deputy Attorney General Lisa Monaco said that for years, TD Bank starved its compliance programme of the resources needed to obey the law. He said the historic guilty plea, including the largest penalty ever imposed under the Bank Secrecy Act, “offers an unmistakable lesson: crime doesn’t pay — and neither does flouting compliance”.

“Every bank compliance official in America should be reviewing today’s charges as a case study of what not to do. And every bank CEO and board member should be doing the same. Because if the business case for compliance wasn’t clear before—it should be now,” she said after the guilty plea.

Principal Assistant Attorney General Nicole M Argentieri, head of the Justice Department’s Criminal Division, said: “For nearly a decade, TD Bank failed to update its anti-money laundering compliance program to address known risks. As bank employees acknowledged in internal communications, these failures made the bank an ‘easy target’ for the ‘bad guys.’ These failures also allowed corrupt bank employees to facilitate a criminal network’s laundering of tens of millions of dollars. US financial institutions are the first line of defence against money laundering and illicit finance. When they participate in crime rather than prevent it, we will not hesitate to hold them accountable to the fullest extent of the law.”

According to court documents, between January 2014 and October 2023, TD Bank had long-term, pervasive, and systemic deficiencies in its US AML policies, procedures, and controls but failed to take appropriate remedial action. Instead, senior executives at TD Bank enforced a budget mandate, referred to internally as a “flat cost paradigm”, requiring that TD Bank’s budget not increase year-over-year, despite its profits and risk profile increasing significantly over the same period. Although TD Bank maintained elements of an AML program that appeared adequate on paper, fundamental, widespread flaws in its AML program made TD Bank an “easy target” for perpetrators of financial crime.

Over the last decade, TD Bank’s federal regulators and TD Bank’s own internal audit group repeatedly identified concerns about its transaction monitoring programme, a key element of an appropriate AML program necessary to properly detect and report suspicious activities. Nonetheless, from 2014 through 2022, TD Bank’s transaction monitoring program remained effectively static, and did not adapt to address known, glaring deficiencies; emerging money laundering risks; or TD Bank’s new products and services. For years, TD Bank failed to appropriately fund and staff its AML programme, opting to postpone and cancel necessary AML projects prioritizing a “flat cost paradigm” and the “customer experience.”

As part of the plea agreement, TD Bank has agreed to forfeit $452,432,302.00 and pay a criminal fine of $1,434,513,478.40, for a total financial penalty of $1,886,945,780.40. TD Bank has also agreed to retain an independent compliance monitor for three years and to remediate and enhance its AML compliance program. TD Bank has separately reached agreements with the FRB, OCC, and FinCEN, and the Justice Department will credit $123.5 million of the forfeiture toward the FRB’s resolution.

Comments