The recent announcement by the Government regarding changes to the Students’ Loan Bureau (SLB) guarantor policy has received widespread approval from the public.

Effective April 1, 2024, SLB applicants will no longer require a guarantor to access tertiary financing.

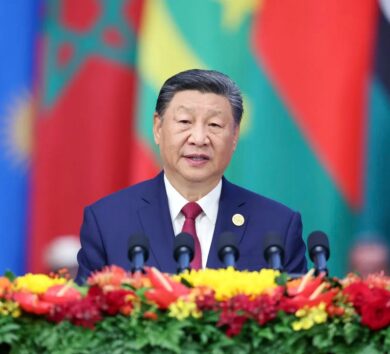

Minister of Finance and the Public Service, Dr Nigel Clarke announced the policy change during his 2024/25 Budget Debate presentation in the House of Representatives. The move aligns with the Government’s goal to enhance access to tertiary financing and expand educational opportunities across Jamaica.

Amanda Stewart, a current SLB guarantor, expressed relief at the decision, stating that the guarantor requirement has long been a significant hurdle for loan seekers. She emphasised that many potential borrowers faced difficulty finding someone willing to assume the responsibility of a guarantor, hindering their application process.

“I am an SLB guarantor, and it is not something I was keen on doing; I was uneasy doing it. I had to sign an agreement to say that if the borrower fails to repay the loan, then I would be obligated to pay… Not many people would want that responsibility and would, more than likely, decline to take that on…,” she noted.

Lavonne Wright, a student, applauded the initiative, highlighting its potential to broaden access to higher education without imposing financial burdens on guarantors.

“It’s a great initiative, especially since it allows more prospective students to have access to getting higher education without having the [need] for guarantors who don’t want to have those financial burdens in case of any discrepancy,” she said during an interview.

Tory Barclay, another student, praised the removal of the requirement and described it as a positive step towards eliminating unnecessary barriers to education.

However, some, like accounts payable officer Sandy Walker expressed concerns about potential loan delinquency risks following the removal of guarantors.

Yet, others like entrepreneur Bob Roberts, supported the change, citing the strain and complexities associated with finding guarantors.

Clarke defended the policy change, arguing that it would address financial inequities by removing barriers for low-income families. He noted the success of previous steps to remove guarantor requirements for wards of the State and Programme of Advancement Through Health and Education (PATH) beneficiaries. He said this has significantly increased the number of students who applied for SLB loans.

Comments