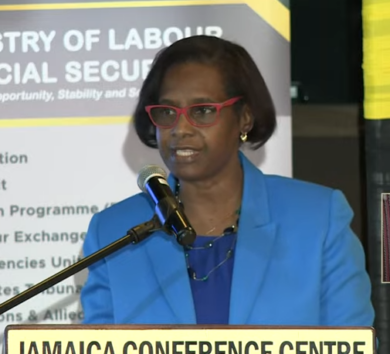

Minister of Finance and the Public Service Fayval Williams, noting that her mantra for 2025 is resilience, says the country has made significant strides in ensuring recovery from natural disasters such as the passage of Hurricane Beryl last July.

“We’ve taken a lot, but we’ve been able to recover quickly and move on. And we could not have done this without having the National Natural Disaster Risk Financing Policy (NNDRFP),” she told attendees at the JSE 20th Regional Investments & Capital Markets Conference, held at the Jamaica Pegasus Hotel in St Andrew.

The NNDRFP is the Government of Jamaica’s response to the possible financial fallout in the light of a natural disaster to mitigate the increased pull on the government’s coffers to finance recovery and rebuilding. Using a multilayered approach that includes parametric insurance, catastrophe bonds and contingency funds, among other financial solutions, the policy requires the Government to establish reserves to treat the costs associated with natural disasters such as hurricanes, earthquakes, and flooding due to heavy rainfall.

“So disaster risk financing is about putting in place a menu of financing instruments that the Government can readily access to respond to natural disasters. And they should give all Jamaicans, all investors in our stock markets, persons and entities looking to invest in Jamaica, it should give them comfort that the Government has this ability – a built-in portfolio of budgets – to give us the ability to respond swiftly,” Williams further explained.

The minister clarified that the Government could not depend on a singular financial instrument to help with recovery, rebuilding and relief given the frequency, increasing intensity and unpredictability of natural disasters. With the layered approach, the Government can access a variety of resources to build disaster resilience and provide financing at each stage of the disaster response process.

“For low risk [events], meaning local floods, landslides, we have contingencies in the budget, reserves, annual budget allocation. We can deal with those,” Williams shared.

“When you get up higher into the medium-risk layer, where you have floods, minor earthquakes, you have to tap into the contingent lines of credit. And then when you get even higher – the large earthquakes, the tropical storms, the hurricanes, you know, like Hurricane Beryl, then you talk about insurance, risk transfer to insurance instruments,” she added.

Following the passage of Hurricane Beryl in 2024 just south of Jamaica, the country was due a payout amounting to US$16.3 million or $2.5 billion from parametric insurance provider CCRIF SPC. The Government of Jamaica also received the proceeds of a settled catastrophe bond from the World Bank in May 2024.

“So this forms part, like I said, of the Government’s multilayered disaster risk management strategy, and we’ve since renewed the bond that was issued earlier, and the one in place right now is scheduled to mature in 2027. And of course, we will evaluate as we go along,” Williams outlined.

“And we continue to have a facility as well in the Caribbean Catastrophe Risk Insurance Facility (CCRIF), in addition to contingency funds and national disaster funds. Again, it speaks to prudence in our financial and fiscal management, ensuring that we have a good foundation for debt sustainability, and enable the Jamaican economy to, you know, take comfort as we go through these adverse impacts. So bottom line, the government remains steadfast on this path, especially in terms of disaster management and recover,” the finance minister continued.

Comments