(Reuters): Capital One Financial’s US$35.3 billion deal for credit card issuer Discover Financial could take a big slice out of the payments processing market dominated by Visa and Mastercard, analysts said on Tuesday.

The all-stock deal would give Capital One access to Discover’s network of payments processing and settlement services, potentially allowing it to cut its reliance on Visa and Mastercard.

“The acquisition is a negative headline for Mastercard and Visa, in our view,” said J.P. Morgan analyst Tien-tsin Huang. Visa shares fell 1.2 per cent, while Mastercard dropped nearly 3.0 per cent.

The pair have come under fire in recent years for the fees that they charge for processing payments, with some lawmakers accusing them of a “duopoly”. Both have denied the allegations.

Capital One said shifting its card portfolio from the big two global payment processors to Discover’s network would help the lender generate US$1.2 billion in 2027.

Any transition by Capital One, however, would likely be slow since both Visa and Mastercard renewed their partnerships with the company recently, Huang said.

Since the two payment processors charge higher fees, analyst at TD Cowen said, Capital One would benefit from moving its lower-spending card customers to Discover.

Shares of Discover rose 11.3 per cent to US$122.95, inching closer to the offer price of US$139.86 after opening at their highest in nearly two years.

The rally also added more than US$3 billion to Discover’s market capitalisation. Capital One stock fell nearly 2.0 per cent.

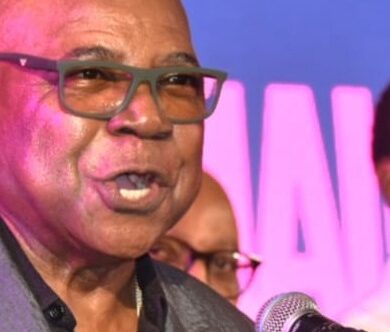

“We will benefit from the additional scale and volumes that come from being the network for other banks,” Capital One CEO Rich Fairbank said.

ANTITRUST CONCERNS

The biggest deal in the global credit card industry, according to Dealogic, is expected to face some tough scrutiny from the Biden administration’s antitrust enforcers.

The combined company will be the number 1 player in a market industry where the top 10 hold roughly 90 per cent of the share, brokerage J.P. Morgan said.

CEO Fairbank said the merger was well-positioned for regulatory approvals and the companies had kept regulators informed, but declined to give more details.

“Regulators are likely to pick carefully through this deal given that Capital One and Discover are two of the largest credit card companies in the United States,” Susannah Streeter, head of money and markets at Hargreaves Lansdown, told Reuters.

“However, given the vast savings in operational costs expected… Capital One believes complex regulatory hurdles are worth being navigated to deliver significant returns.”

The deal was opposed by Washington-based advocacy group National Community Reinvestment Coalition.

“It is very difficult to imagine how federal regulators could allow Capital One to buy Discover given the requirement that mergers benefit the public as well as insiders,” its president and CEO Jesse Van Tol said.

Comments