Speculation and interest in the operations of Barita and its principals continue unabated.

A day doesn’t go by without a concern being raised and answers sought.

Now the calls for the regulators to examine Barita and its spectacular performances has been heeded with the FSC insisting that an addendum to the prospectus of its latest APO be released to further inform the public and shareholders.

Barita has now produced that addendum.

Jamaica has good regulators and it is heartening to see them acknowledge and respond to issues concerning Barita.

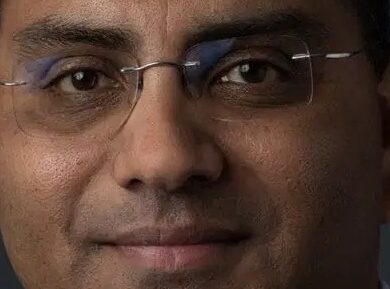

John Robinson, an experienced and well-respected central banker is now heading the FSC.

He is not to my knowledge a connected party. His perspicacity on this matter will be invaluable.

If nothing untoward is discovered and unveiled then Barita can rest easy, comforted that this can be put to bed once and for all, with clouds of doubt cleared.

However if there are concerns, they will have to be addressed and Barita will have to provide fulsome explanations.

Uncertainty should not be allowed to persist.

Anthony Wilson of the The Trinidad Express has written a number of well-crafted articles on this matter and they stand as testaments that quality business journalism is still practiced in the Caribbean. Answers should be provided to the questions he has posed, more so from a listed financial institution that has aspirations to be a ‘big dog’ in the region.

Better still why not sit down with him and do a no-holds barred interview? Now that would give credence to both Paul Simpson and Barita’s stock!

All too often we see personalities and entities turn to Facebook and YouTube to control their ‘messaging’ a la Trump style. This hampers the credibility of what is being said because it vitiates scrutiny and is predicated on self-editing.

This has now become the modus operandi of ‘influencers’, ‘communication specialists’ and ‘marketers’ all in a hurry to bombard us with their crafted offerings. It sure is a sign of the times.

If you are confident in your unvarnished truth then you call speak truth to power regardless of the inquisitor.

There are those who conjecture that Barita’s competitors are envious of its success and have pursued machinations to derail its latest APO and besmirch its brand.

Others say, “its bad mind,” and there is a concerted effort to bring down young investment banker Paul Simpson, who formed Cornerstone, the vehicle that acquired Barita Investments. Simpson serves as Cornerstone’s Group President.

What is an unarguable fact is that if this APO should have a successful landing, Barita Investments will have a larger market capitalization than that of the Grace Kennedy Group (over J$100 Billion).

It would have raised an inordinate amount of money (a likely total of J$33.5 billion if the APO is successful come September 23) in a short period of time which begs the question, why would Barita raise so much money now and then pay out a big dividend of over J$4 billion weeks later?

Here are some questions for Paul Simpson and the team at Barita to which the answers will go some way in providing greater clarity.

1. This week you returned to the capital market with an APO looking for an additional J$10 billion. This is in addition to the J$23.5 billion raised from the rights issues of 2019 and the first APO last year.

What is the plan for all this money amassed?

2. How many deals has Barita done in the last two years and where are they on the balance sheet?

3. Were investors in Barita Investments aware that Barita Finance was not a subsidiary of Barita Investments?

4. Does Barita Investments sell Barita Finance promissory notes or bonds?

5. What percentage of Barita Finance’s total assets are lent to Cornerstone and related party entities?

6. Now more than ever there is a generation of younger people interested in the investment market in Jamaica. What is your view on this and how do you see the investment prospects in Jamaica?

7. Given the intense interest in real estate and the boom in the construction sector in Jamaica, what does the future hold for this arm of the economy?

8. Paul Simpson, why did you become an investment banker? Do tell us about your career to date?

9. What led you to form Cornerstone?

10. Is Barita looking to acquire a commercial bank? There was talk of Barita potentially acquiring First Caribbean. What transpired there?

11. Tell me about 294 Inc. What is its function?

12. 294 Inc held 11 million shares in Barita Investments last year. How many shares does it now hold, and does it have shareholdings in other companies? Can you list those companies?

13. What is your precise role in 294 Inc?

14. Why did Cornerstone acquire Barita? What made it an appealing asset to hold?

15. Cornerstone’s investment of US$22 million in Barita in 2018 is now worth almost US$500 million in just three years. Phenomenal! Explain this performance and the key levers that produced this?

16. Barita has marketed itself very well. Its branding is ubiquitous. Do talk about its marketing and branding strategies?

17. Cornerstone has acquired over 821 million shares in Barita Investment, holding 75 per cent of the company. The second largest shareholder is Trinidad’s First Citizens Bank. How do you intend on bolstering the retail side, get more ordinary shareholders on board? Is there a plan?

18. As one of the lead principals whose holdings in Barita is valued at close to US$500 million, where does Cornerstone see Barita going? What is its long-term objective for this finance house?

19. Trinidad’s First Citizens Bank has a significant stake in Barita and sees that investment as a handsome capital gain. Tell me about your relationship with First Citizens Bank?

20. Earlier this week a spokesperson for Barita declared that a significant portion of the funds raised will be earmarked for infrastructure projects. What percentage of Barita’s portfolio will this comprise and how do you see infrastructure development in Jamaica?

21. Exactly what infrastructure projects are Barita targeting?

Comments