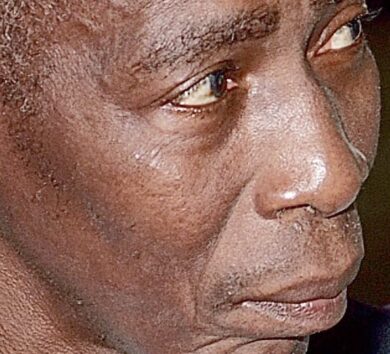

Finance Minister Dr Nigel Clarke says the implementation of the proposed transition to the twin peaks model of supervision and regulation of the financial sector is expected by 2026.

“A twin peaks concept paper, which sets out the legal and operational contours of the model, was prepared and submitted for my approval by the BOJ (Bank of Jamaica)-FSC (Financial Services Commission) twin peaks steering committee chaired by the Bank of Jamaica governor in 2023.

The concept paper has been approved, and we are now in the final stages of the preparation of a Cabinet submission for consideration and approval by the Cabinet, following which formal drafting instructions will be issued for the development of the bill to address proposed changes to the law to give effect to the twin peaks model of financial regulation in Jamaica,” Clarke said while speaking in the House of Representatives on Tuesday, June 11.

The proposed twin peaks model is geared towards reforming and enhancing the system of supervision and regulation of the financial sector in Jamaica.

The Bank of Jamaica will assume full responsibility for prudential supervision of all bank and non-bank financial institutions.

Meanwhile, the FSC will be transformed into a new regulatory entity that will supervise all bank and non-bank financial institutions from the perspective of market conduct and the protection of consumers of financial services.

“The adoption of the new twin peaks model will change the existing bifurcated supervisory architecture and sector-by-sector regulatory approach. This approach presently sees the BOJ as the regulator for deposit-taking institutions (DTIs) only, with the FSC having regulatory oversight for non-DTIs only. The new regulatory architecture, once implemented, will see the prudential regulation of commercial banks, building societies, merchant banks, micro-credit institutions, and eventually credit unions, along with non-DTIs, comprising securities dealers, insurance companies, and pension funds, being consolidated into one regulatory peak under the supervision of the BOJ,” the Finance Minister said.

Clarke added that all market conduct and consumer protection regulation will be consolidated in the other peak under a proposed Financial Services Conduct Authority (FSCA), which will be a successor agency to the FSC.

The FSCA, upon full implementation of the Twin Peaks model, will be responsible for market conduct

regulation and financial consumer protection for all operators in the financial sector, whether they are DTIs or non-DTIs.

The Finance Minister says urgency and priority are being given to the development of the twin gates legislation. Clarke said the twin peaks practice period is scheduled to commence this quarter and will run through to the selected appointed date when twin peaks legislative changes come into effect.

The twin peaks practice will occur in phases.

- Preparation Phase: The aim of this initial phase is to build capacity of the members of FSC and BOJ teams assigned to market conduct and prudential regulation, through training.

- Pilot Phase:

- The Pilot phase will seek to further deepen the capacity building process by:

- (a)Carrying out simulation exercises involving the application of proposed

- requirements and supervisory models that will be implemented when Twin Peaks

- goes live, to mimic real-life regulatory cases both prudential and market conduct;

- (b) Commencing a joint examination of selected conglomerates which have both DTI

- and Non-DTI operations; and

- (c) The publication of joint-standards which will govern the behaviour of licensees of

- BOJ and FSC under both the prudential and market conduct/consumer protection

- ‘Peaks.’

- Practicum Phase: During this phase staff from BOJ will be seconded to FSC and vice versa in order to

gain deeper exposure in the supervision and regulation of all segments within the

financial sector.

- Implementation Phase: This phase will allow for seamless transition to Twin Peaks by implementing in both regulators the operational structure that it is anticipated will exist after legal cut-over. Until legal cut-over, the two regulators will continue to utilize existing laws in terms of approvals/rejections, on-site examinations, off-site monitoring, risk mitigation/prompt corrective action and enforcement.

Comments