Durrant Pate/Senior business journalist

President Dr Irfaan Ali says his administration is implementing several measures to establish and operationalise a foreign exchange control plan that would be administered by the Guyana Revenue Authority (GRA).

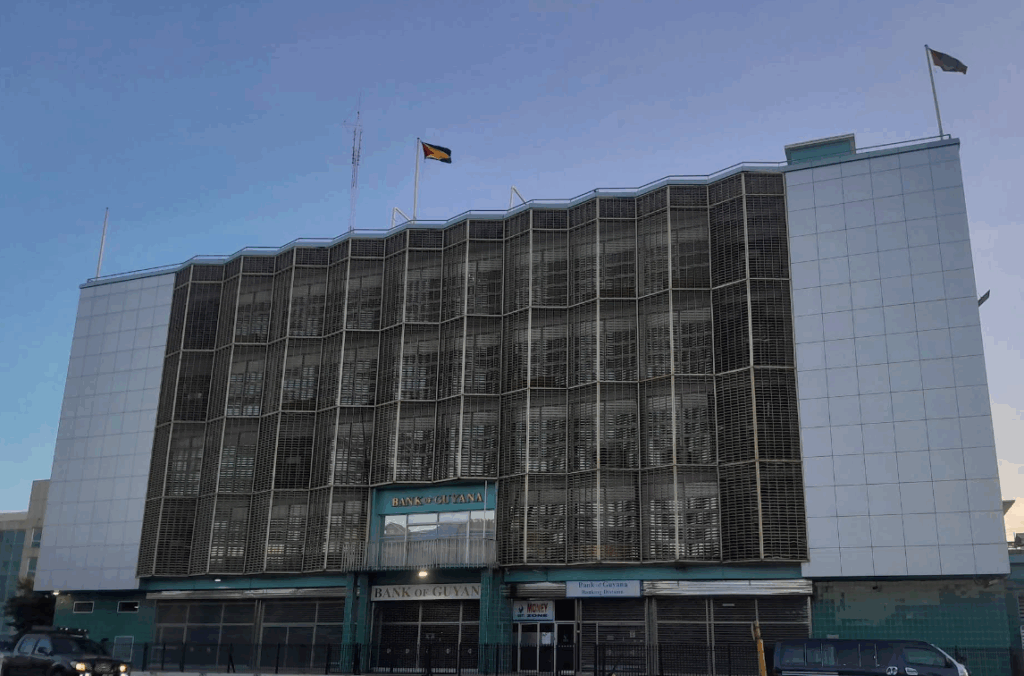

Under the new measures, local commercial banks and the Bank of Guyana (BoG) would stem the outflow of US dollars that has now almost quadrupled over the past year to about US$1.2 billion. In making the announcement through a statement issued by the Office of the President, Ali disclosed that the new measures would require importers to provide their invoice, bill of lading and GRA compliance to commercial banks before payments are released.

According to him, “the implementation of these nine standard operating procedures (SOPs) is designed to tighten foreign exchange (FX) controls, improve transparency, and prevent abuse of the system, especially in the context of rising demand and capital flight.”

As another measure to curb excessive domestic greenback demand, the president mandated that commercial banks monitor credit card usage to ensure they are being used for personal rather than business transactions.

Citing a sharp escalation in credit card usage as part of his broader concerns about FX outflows, Ali highlighted that in 2023, total credit card clearance stood at approximately US$91.3 million, but this figure surged to US$347.5 million in 2024, marking a nearly four-fold increase. In 2025, the figure has already reached close to US$252 million, signalling continued high volume activity.

Providing statistics showing the central bank’s intervention in the foreign exchange market, Ali referred to 2024, when the BoG provided US$332 million to meet foreign exchange demand, which has now risen to US$1.2 billion in 2025, with an additional US$160 million still pending.

The imposition of the foreign exchange control plan was made after a meeting with several stakeholders of the financial sector, including the BoG Governor, Dr Gobin Ganga; GRA Commissioner General, Godfrey Statia, and representatives of commercial banks operating in Guyana.

Also attending the meeting was Minister of Public Service Zulfikar Ally.

President Ali also announced that an interagency task force, including technical support, was convened to comprehensively review the increase in demand for foreign exchange. He emphasised noted his administration has made several interventions over the last three years in the foreign currency sector.

Comments