MyCash, a digital wallet app enabled by Paymaster has launched Jamaica’s newest digital payments experience that is said to help citizens manage their cash easily, conveniently and securely.

First launched back in 2018 as a pre-paid card, MyCash is now a fully digital offering that allows users to secure their funds and perform financial transactions from the convenience of their mobile phones.

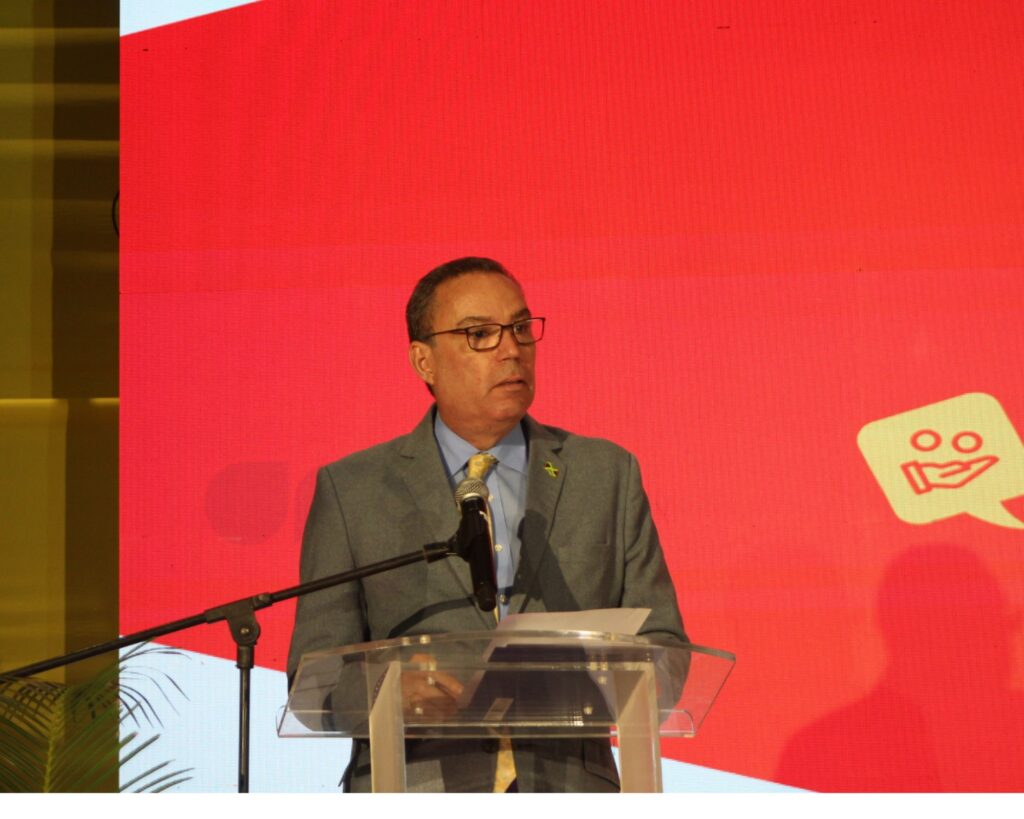

Speaking at the launch of the digital wallet today (March 28), Kevin Chin Shue, general manager of Paymaster limited and the head of Digicel Financial Jamaica, said that the wallet provides and an opportunity for Paymaster to influence the habit changes in customers.

“In the end, what we want for MyCash users is to manage their finances at their own pace, with no surprises guaranteed…We aim to contribute to the gradual shift away from a cash based economy, into a society where digital money solutions help people to feel included and empowered to participate,” said Chin Shue.

The MyCash by Paymaster app is available in the app store on any smartphone device. Prospective customers can download the app and set up their account with a tax registration number (TRN), valid identification and a phone number from any mobile provider on the island.

To add funds to the wallet, customers can visit any Paymaster MyCash location islandwide. Customers will soon be able to add funds by making transfers from their debit card or credit cards. The app will also enable its users to send funds from their wallet to other MyCash wallet holders, make bill payments and top up their mobile phones with credit.

Chin Shue shared that the digital wallet provider is also working with the Bank of Jamaica (BOJ) and Mastercard to offer digital and prepaid Mastercards so that users can shop online and use point of sale machines islandwide. He added that the team at MyCash is also working with the BOJ to allow users to receive remittances and international transfers directly to their wallets.

“As we build the MyCash eco-system, we’re also opening opportunities for Jamaicans to create in the digital space and supporting the growth of the economy. By expanding our MyCash Paymaster agent network, we support job growth and opportunities for businesses to partner and earn with MyCash,” said Chin Shue.

As such, all businesses and merchants whether big or small will be able to collect their payment for goods and services as well as pay their employees through the wallet. The MyCash by Paymaster team is also working to allow customers to make transfers to other digital wallets in the island such as Lynx.

With security as a top priority, the app also features SMS verification and facilitates the encryption of user’s data.

Also, in attendance at the event was Daryl Vaz, minister of science, energy and technology who said that digital wallets have been accepted by several international countries but are not widely accepted in Jamaica.

“By having a branch such as Paymaster, a subsidiary of Digicel, that is already widely known and trusted by many entering this market, Jamaicans are now more likely to buy into the idea of a cashless society, which is the ultimate goal for our country,” said the minister.

He added that the benefits of a digital wallet allows for better financial management and facilitates contactless check out, while improving citizen’s economic security by minimising theft and reducing the need to travel with card or cash.

“Transition from cash to cashless is going to be a process and is going to require a sustained public education campaign between government and the players so that it can be done in a way that will move it that much faster, especially in light of what’s happening with the banks downsizing, in terms of their branches and the accessibility of the average Jamaica living in rural communities to be able to access cash,” added Vaz.

The minister noted however, that sustained public education is needed so that Jamaica can make its transition to a digital society, reaching those even in the rural area.

A panel discussion also took place at the launch of the digital wallet. Panelists included Aniqa Sandhu, CEO of Digicel Financial Services and Kalilah Reynolds, business and financial journalist, entrepreneur and social media personality.

During the discussion Sandhu said that the app will be very convenient for users and it is the team’s aim to have government disbursements that will allow users of the app to skip long lines at the bank and bill payment facilities.

Reynolds also praised the MyCash Paymaster team for the launch of their app which she said is very timely, given the recent news that banks like the National Commercial Bank (NCB) will be closing down some of their ATMs.

She added that the closure of these ATMs will make it increasingly difficult to do business with cash, especially because of the security risks that come with using cash. As such, she believes the app is a timely solution that allows citizens more options to conduct business.

– Send feedback to [email protected]

Comments