MYNE LEND, a digital lending platform and tap-to-pay solution, has officially been launched in Jamaica.

This initiative is the result of a strategic venture between JMMB Group, Liberty Latin America, and Flow Jamaica in partnership with Visa and Evertec.

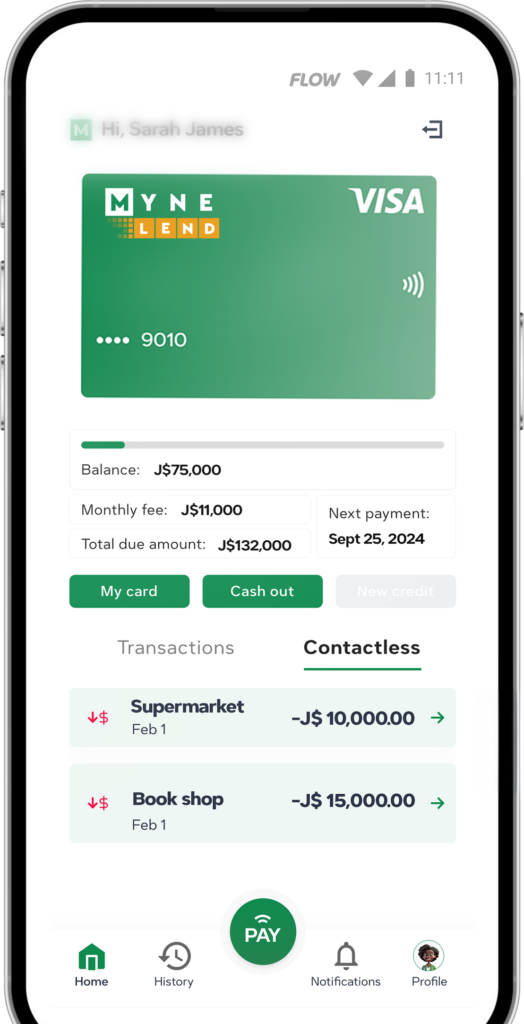

MYNE LEND will be available exclusively to Flow mobile customers and promises a ground-breaking financial experience for customers as Jamaica’s first 100 per cent digital wallet and microlending service offering a tap-to-pay feature.

“MYNE LEND is not just another addition to the market; it’s a transformative experience,” said Elson James, CEO of MYNE LEND.

For the first time in Jamaica, MYNE LEND introduces an alternative credit scoring methodology to provide credit decisions in as little as 10 minutes.

Successful applicants receive a digital VISA card directly in the MYNE app, enabling instant spending.

Approved customers can access renewable loan amounts up to J$150,000.

The MYNE app is comparable to well-known mobile payment systems like Samsung Pay and Google Pay due to its ability to “Tap-to-Pay” directly from the app, with no physical card required.

“Our connectivity and technology platforms provide endless opportunities for our customers, and in the case of this partnership, we are enabling financial inclusion and access to credit and digital payments and wallets in one go. MYNE LEND represents an exciting step for us on our journey to enhance the value that we offer on our network, and we are very proud that our customers will have the first access to this ground-breaking initiative,” noted Stephen Price, VP and general manager, Flow Jamaica.

Keith Duncan, JMMB Group CEO, commented: “Given that a significant percentage of Jamaicans are underbanked or have little to no credit history, MYNE LEND aims to become a financial pillar for many. We are offering a responsible, quick, and secure way to access credit.”

MYNE LEND’s launch represents a significant stride towards enhancing financial accessibility across the island.

“We’re proud to be part of this launch, utilizing Tap-to-Pay technology to innovate and expand credit access in Jamaica. This initiative not only stimulates economic growth but also empowers previously underserved segments of society, marking a significant step towards financial inclusion. Furthermore, it enhances transaction security, ensuring that Visa customer data remains consistently protected,” said Frank Gandarillas, country manager of Visa Jamaica.

By leveraging advanced digital technologies, MYNE LEND simplifies the borrowing process and provides unprecedented access to financial services for many Jamaicans.

This innovative approach ensures that even those with limited credit histories can achieve financial stability.

“Our collaboration with JMMB Group, Liberty Latin America, and Flow Jamaica is redefining financial norms and creating a landscape where financial independence is within everyone’s reach. We are committed to providing a platform where Jamaicans can thrive economically and confidently step into their financial futures,” said James.

Key benefits of MYNE LEND

•Alternative Credit Scoring: Expanding financial inclusion and addressing credit access challenges.

•Financial Inclusion: Promoting sustainable economic growth, social development, and poverty reduction.

•Empowerment: Enhancing financial independence and opportunities for Jamaicans island-wide.

•Security: Utilizing advanced security protocols, including tokenization and biometric authentication, to protect user data and transactions.

• Innovation: Incorporating Tap-to-Pay technology with a secure digital wallet.

Comments