Durrant Pate/Contributor

Leading Caribbean fintech company, Carilend—also associated with VM Investments—has partnered with Massy Finance to expand its services to Trinidad and Tobago.

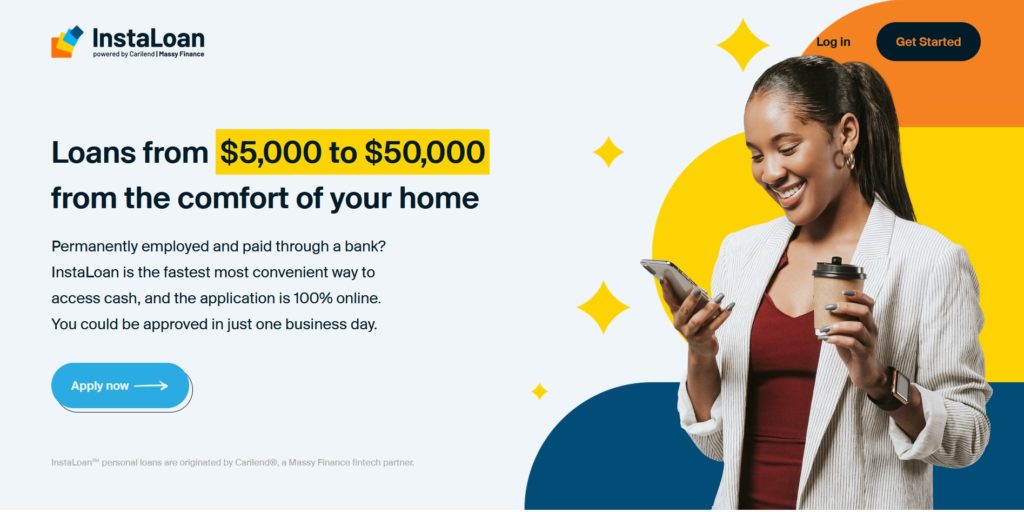

Carilend, in which VM Investments Limited acquired a 30 per cent stake in 2019, is now offering 100 per cent web-based personal loans in Trinidad. The new online loan, dubbed InstaLoan, is an unsecured personal loan that promises a one-day turnaround on approvals, and doesn’t require borrowers to provide collateral.

Customers can qualify for loans between TT$5,000 and TT$50,000 with repayment terms from one to five years. Under the deal, which was finalised in May, Massy Finance and Carilend will tap a mix of technology and data inputs to reach more borrowers online.

Carilend had already opened a local office in anticipation of increased demand for InstaLoan, which borrowers can apply for at instaloan.massyfinance.com.

The official launch is scheduled for July 14 at the BRIX hotel in the capital Port-of-Spain.

Strong and growing demand

Commenting on the move into the twin-island republic, Rezworth Burchenson, CEO of VM Investments Limited, explained, “Carilend’s move into Trinidad and partnership with Massy Finance show the strong and growing demand for convenient, online access to loans, as well as the increasing respect for the Carilend brand. VM Investments’ decision in 2019 to partner with Carilend was the result of careful analysis. We saw then the tremendous growth potential of the business and the robust strategy in place for Carilend’s continued expansion.”

He adds that VM Investments is expecting great things from Carilend and Massy Finance’s partnership in Trinidad.

According to Massy Finance’s managing director, Duane Hinkson, “InstaLoan is an ideal option for borrowers looking for a fast, easy, and secure way to apply for credit to meet expenses like credit card debt, home improvement, car repairs, and unplanned emergencies without the back-and-forth associated with traditional brick-and-mortar lending.”

Continuing, Hinkson said, “We see this partnership as an opportunity to provide financing to more people while moving the bank toward digital maturity, so we’re especially interested in those customers who rely on their phones to do everything. InstaLoan would be an excellent option for this group.”

Mark Young, Carilend’s chief executive, believes the timing may be right for the move toward online lending, not least because of the COVID-19 pandemic.

He pointed out that, “After COVID, the emerging picture is clearly one where people want to do everything online. Borrowing is no exception, so the industry as a whole has to respond, and that’s what Carilend and Massy Finance are doing. Quick, easy, and convenient is our business model.”

Comments