WiPay Remittance has launched cash payout locations in Trinidad and Tobago, marking the start of a phased expansion across the Caribbean.

The company stated that the initiative provides recipients with more options for accessing remittances and is a key step in WiPay’s broader regional strategy.

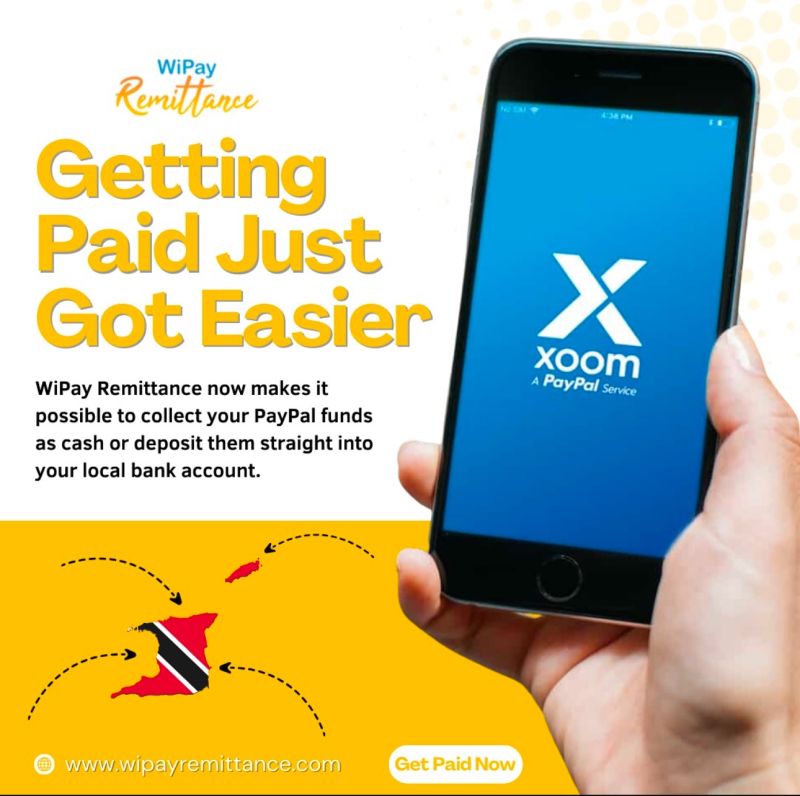

Through WiPay Remittance, recipients of funds sent via RIA Money Transfer, PayPal, XOOM, and Remitly can now collect their payouts through multiple channels, including cash pickup, direct-to-bank deposits, direct-to-card, and digital wallet transfers.

“This development strengthens WiPay’s commitment to modernising remittance services across the region,” a statement continued.

Expanding payment options for the digital economy

A key part of WiPay’s remittance expansion is the COLOUR App and COLOUR Card, which provide recipients with seamless access to their funds.

Recipients can receive money directly into their COLOUR Account, which is linked to the COLOUR Card, simply by downloading the app to their phone. This eliminates the need to visit a physical location, giving recipients immediate access to their funds for everyday transactions, online purchases, and ATM withdrawals. While common in other global markets, this capability is new for the Caribbean.

It helps e-commerce businesses, gig workers, and individuals receiving online payments overcome a major challenge in accessing their funds locally.

WiPay Remittance is bridging the gap between digital earnings and real-world spending. Currently, the COLOUR App and COLOUR Card have over 10,000 active users in Trinidad and Tobago, serving as the foundation for future Caribbean expansion.

Strengthening regional payment networks

The Caribbean remittance market plays a crucial role in the region’s economy, with the English-speaking Caribbean receiving over US$14 billion annually in remittances.

As digital transactions grow, WiPay is expanding its platform to offer faster and more cost-effective payout solutions tailored to the region’s evolving financial landscape.

“At the WiPay Group, we recognize that money is changing. Digital transactions are the future, and we are pioneering solutions to connect the Caribbean to the global digital economy,” said Kibwe McGann, chief marketing officer of WiPay Group.

“The launch of cash payout services in Trinidad and Tobago is just the beginning. Our goal is to expand WiPay Remittance’s footprint across the Caribbean and into other territories, including Ghana and Colombia.”

As part of its expansion and diversification strategy, WiPay Remittance will continue onboarding additional global remittance and cash payout partners to enhance accessibility and affordability.

Under its remittance brand, WiPay will offer direct-to-bank transfers, direct-to-card payouts, direct-to-wallet transactions and cash pickup at retail partner locations.

Comments