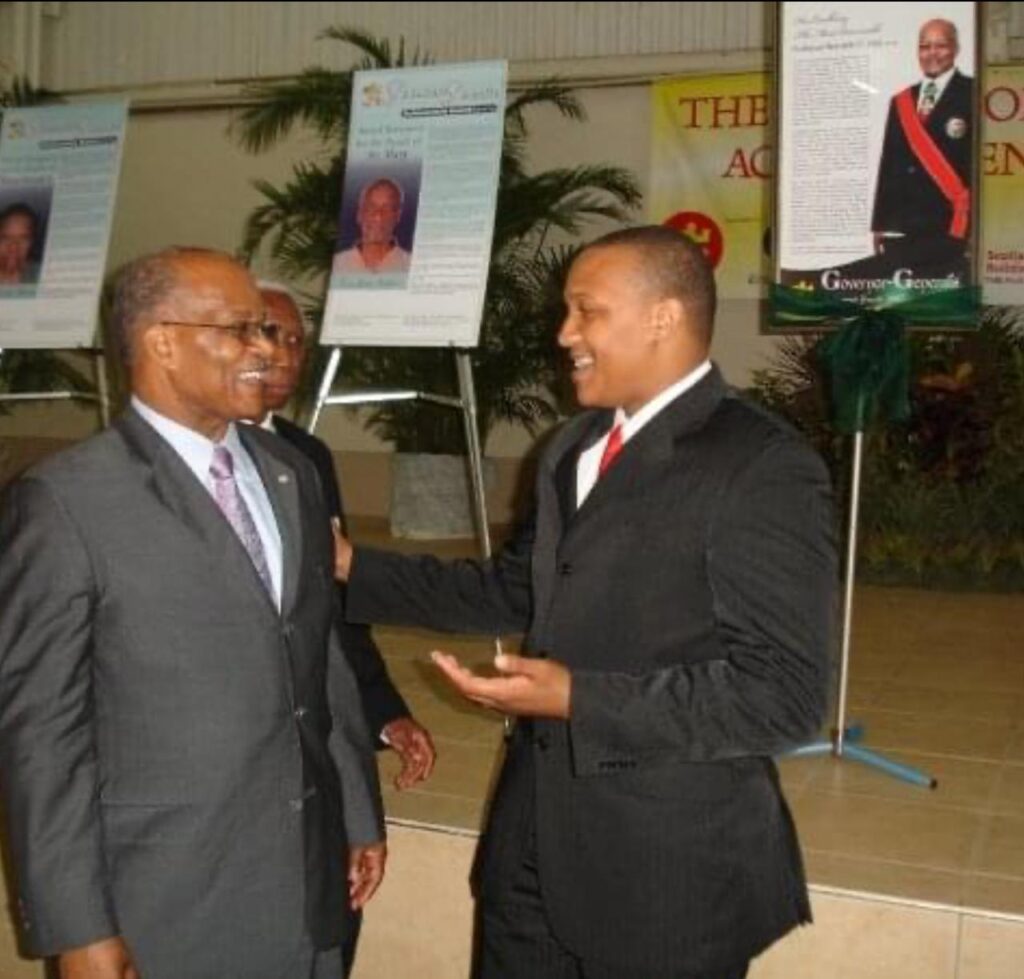

Founder, group president and CEO of investment house Cornerstone Group, Paul Simpson will be awarded the national honour of the Order of Distinction in the rank of Commander (CD).

This a remarkable achievement for a young man who at the age of 41 has ascended to the top of the local financial sector with a number of blitzkrieg deals.

When young people are awarded national honours in Jamaica, more often than not it tends to be for entertainment or sport, think the likes of Sean Paul and Usain Bolt.

It’s rare to be this young and be awarded one of your country’s top honours for building financial investment houses.

In the wake of FINSAC, foreign entities more specifically Canadian ones dominated the financial sector. Local players’ confidence was shot and they remained reticent.

Come a new century, a new decade a new generation of Jamaican business leaders has emerged and Paul Simpson stands out among them.

Some of us remember when Scotia, CIBC, and RBTT ruled the financial roast with local firms playing second and third fiddle. This is not the case today and Paul Simpson has played an instrumental role in in this regard.

He gets the national award in recognition of this, for leaving an indelible mark on the financial sector, for invigorating new hope and inspiring a new generation.

Paul Simpson hails from Harbour View in Kingston. Both his parents were teachers and his father later went on to become a pastor. He comes from an academic family who excelled in the sciences. His two sisters went to medical school aged 21 and he has a cousin who is one of Jamaica’s first Rhodes Scholars.

He holds a first degree in Mathematics and Computer Science and a second degree in Geology. Completing his degrees at 21 and with exceptional grades, he was recommended to work at the Computer Science Department at the University of the West Indies (UWI). He did so for 6 months before going on to the Mona School of Business to do his MBA.

Armed with a rock solid education and with an MBA in hand, he began his career after pondering entering pre-Med school.

He began his career at Guardian Asset Management (GAM), headed by Lisa Gomes in 2007 as an investment adviser where attention was paid to his way with clients. His talent was evident and he was able to get clients to willingly sign on the dotted line.

Jason Chambers was head of investments at GAM and they would later work together to build Cornerstone.

In January 2008, Simpson met with Peter Bunting in Mandeville where they spoke about the operations of his investment house, Derhing Bunting and Golding (DBG). Young Simpson was impressed and more so when the company was sold to Scotia Group.

They spoke about starting a venture together and what that was likely to look like. He went one step further, telling Bunting that when his non-compete with Scotia was completed, he would like to hitch his wagon to Bunting’s.

Simpson was making a name for himself with his dynamism and chutzpah. The chairman of Mayberry Investments, Christopher Berry was paying attention. In 2009, he asked Simpson to join Mayberry as vice president of sales. Simpson kindly turned down the offer, keen to join Bunting in what was to become Proven.

In the penultimate year of a new decade in a new century Paul Simpson resigned from GAM to embark on a new adventure called Proven. Bunting and Golding named the new venture. Simpson added to that with the tagline, ‘We Are Proven’.

Working behind the scenes to raise capital for Proven, Simpson knew all too well what a prize his place of former employment GAM was, so he pitched to encourage Bunting that it would be a great acquisition. He worked assiduously to put things in motion. Six months after leaving GAM, he set about seeing to it that Proven acquired the company that launched his career. It was his first acquisition deal; he was yet to turn thirty.

“Chris Williams was a big star at NCB Capital Markets with a proven track record. He left NCB to become CEO of Proven with Johann Heaven leaving Scotiabank to join Proven. They were both senior to me at the time but I knew the clients. I raised circa US$16 of the $20 million needed to get started,” Simpson recounted to Our Today.

It was that ability to raise capital that would serve him well in the future with both Barita and Cornerstone. Proven was a testing ground,a forerunner to what was to come.

In 2010, Simpson led Proven’s rights issue but was not a partner in the business. The following year tensions grew between himself and Proven’s CEO Chris Williams who is also mercurial and assertive. Something had to give. By this time, Simpson fervently believed in ownership and without a stake, it was easy to be told to get on your bike and be kicked out with no accounting for what you have brought to the table or achieved for your employer.

To this day he remains good friends with the original founders of Proven, Peter Bunting, Mark Golding and Garfield Sinclair and maintains that for his contribution, he cannot be erased from Proven.

He decided to set up his own shop, becoming an entrepreneur, determined to build a business. It was a bold and brave move. He was flying without a net. To many it is scary and they do not have the constitution for that kind of risk-taking. They are plagued by the question, What if I crash and burn? That held no paralysis for Paul Simpson.

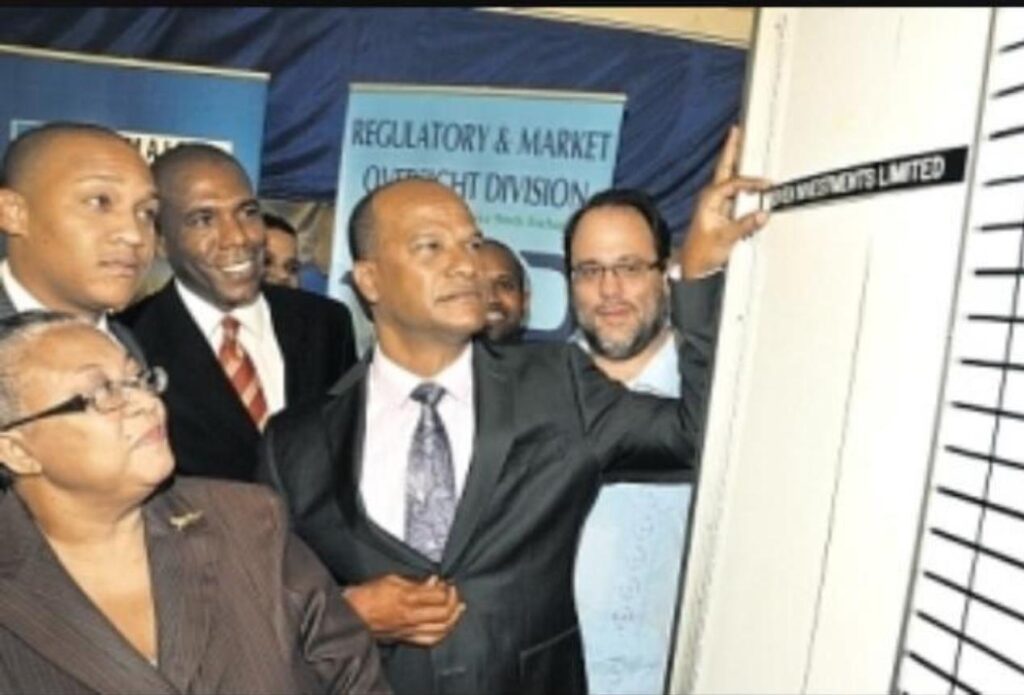

The following year 2013, Simpson formed Cornerstone an investment vehicle where this time he would both own and run things. He did not sit on his laurels, he moved quickly to acquire an 80 per cent stake in the 48-year-old merchant bank Myers, Fletcher & Gordon Trust and Merchant Bank. He attributes present Investment Minister Aubyn Hill for encouraging him to raise the money and buy the merchant bank. He remains very grateful to him. Peter Goldson, who was the managing partner at MF&G and played a significant part in the acquisition nows sits on the board of directors of Barita and is chairman of its corporate governance and conduct review committee.

Buoyed by this acquisition, Simpson turned his eyes upon Barita, the oldest brokerkage house in Jamaica, formed in 1977 and led by the indefatigable Rita Humphries Lewin. He got wind she was looking to sell and had five suitors but opted for Simpson and Cornerstone. In 2018, Cornerstone acquired 75 per cent (334,407, 618) ordinary voting shares in Barita at a price per share of J$9.20 making the total consideration payable, J$3,076,550,085. A year after Cornerstone took over Barita, the investment house raised$10.3 billion in new equity capital. That same year Barita’s profits skyrocketed by 380 per cent.

Speaking about Barita’s success, its current CEO Ramon Small-Ferguson reflected, “When we acquired the business in 2018, over a third of its revenue was generated from net interest income with another large portion coming from the management of unit trust funds. What we set about doing is not just simply scaling the business but moving away from relying on net interest income. We got net interest income to contribute less than 10 per cent of revenues in 2023, down to around $580 million of a $9 billion revenue mix. That was down by about a third from 2018’s numbers.”

In half a decade, Barita has grown its market capitalisation to $85 billion.

In 2021, Barita raised $13.5 billion in one of the largest APOs listed on the Jamaica Stock Exchange (JSE). Today Barita has raised a total of $33 billion and only nine per cent of that total is its real estate portfolio. The rest is high-quality liquid assets and corporate paper.

In December 2022, Paul Simpson turned forty. He has worked hard to become a major player on both Jamaica and the wider Caribbean’s financial landscape. His accomplishments are lauded.

Over the last two years, he has secured in excess of 2000 acres in real estate property in Jamaica. From 2018 to 2023 Barita raised $119 billion in capital for its clientele which spans local, regional and international markets.

Earlier this summer it was announced that Cornerstone would be acquiring a 70 per cent stake in Bermuda’s banking outfit Clarien Group. That deal is now awaiting regulatory approval. NCB, Portland Holdings and James Gibbons will retain a 30 per cent share between them. Our Today understands that Clarien has a book value of US$144 million with US$2.5 billion in assets under management.

Over a five-year period, Cornerstone has done a remarkable job of building the business from US$100 million to US$2.5 billion in assets under management with its equity position moving from US$13.7 million to over US$500 million.

Cornerstone is now one of the leading investment companies in the Caribbean, with assets of J$365 billion (US$2.5 billion) under management. It is the parent company of Barita Investments and together with its other holdings across different industries now has total assets of closer to US$900 million.

Only last week, chairman of Cornerstone Mark Myers was seen in close discussion with the head of one of the biggest securities dealers in Jamaica at the Terra Nova hotel in Kingston. Could another momentous deal be on the horizon.? Will this deal bring Cornerstone to obtaining critical mass in Jamaica’s financial sector?

“I want to help build Jamaica. To be recognised as one of the builders of the country is a notable legacy but one cannot accomplish this alone. Other more experienced business leaders need to rally around this current generation and we welcome their guidance. It is vitally important that we all see Jamaica make progress and its people prosper.

Business leaders have come forward to congratulate Paul Simpson on his National Honour and his contribution to Jamaica’s financial sector.

Peter Bunting, shareholder and one of the founders of Proven Investments: “I met Paul around 2008 in Mandeville, I think he was 25 at the time. He was very ambitious and driven. He decided I would become his mentor and we became friends. We talked about the Jamaican financial sector and forming a new kind of investment house. You have to remember back then we were a start-up and we had to be very mindful of the cash and capital we were operating with. We couldn’t pay Paul but he told me he would work for free! He did and what a fantastic job he did. He proved his worth and within three months we paid him a full salary. He became assistant vice-president [of] investor relations.

“It is heartening to see his progress and development and the impact he has made on the financial sector. I was at his wedding and he has matured since becoming a husband and father. Paul Simpson is definitely a consummate dealmaker.

Keith Duncan, group CEO of JMMB: “Paul with his strong entrepreneurial skills has certainly blazed a trail in the financial services area. He is certainly a dealmaker and has utilised his great marketing skills in marshalling the confidence and capital of strategic investors and the investing public to take a household brand like Barita to greater heights.

“I wish him all the best in building a solid group of companies.”

Minna Isreal, Special Advisor to the Vice Chancellor, The University of the West Indies: “ I admire Paul and what he has accomplished. He is a hard worker and is very focused. I have always found him willing to discuss and make a contribution to our proposed projects. He has done very well for both his company and the financial sector. What he has done is truly transformational ( at such a young age) and this has had enormous impact and has anchored his role as a leader in the financial sector. This award will certainly inspire and motivate young professionals and entrepreneurs to take ‘calculated’ risks, surround yourself with talented individuals to monitor and manage the risks while supporting the communities you work in and your nation. I am proud that he is a very successful UWI alum.”

Chairman of Mayberry Investments, Chris Berry wrote on X: “Congrats Paul on receiving National Honours for your contribution to the banking sector….Big!”

Chairman and majority shareholder of NCB Group, Michael Lee-Chin: “Congratulations to Paul Simpson on the accolade being bestowed on him by his country. When your country recognises you for who you are, it is really humbling. He has always been a good representative of the best of Jamaica, that’s why I gravitate to him for his sincerity, his passion, his energy towards making our people better. You represent us well. I’m happy and proud to be your friend. It is only onward and upward and bigger and better things for you Paul. You have lots of runways and great potential. You are showing who you really are and your country recognising it is fantastic. Congratulations Paul.”

Mark Myers, chairman of Cornerstone Group: “Paul and I have been working together for nearly ten years and I find him to be a very driven individual. He is constantly working and I sometimes wonder when does he make time to sleep! He is a high performer always looking to provide a world-class offering for the business, shareholders and staff.

“He is looking to change the way the financial sector operates which tends to be staid and very traditional. He has shook things up and made some incredible deals. He has delivered excellent results that are not only good for consumers but will benefit the country. That is now being recognised, hence the national honour.”

Founder and CEO of Dequity Group, Kadeen Mairs: “The risk he took in acquiring Barita and turning it into the powerhouse that it is in less than five years is phenomenal. He has to be praised for building a young talented team and giving opportunities to Jamaicans in the financial sector. Ramon Ferguson Smalls is young, talented and capable and he made him CEO, and that shows you what kind of leader Paul Simpson is. He has provided much-needed capital for Jamaican businesses across different sectors.

“I admire his philanthropic work and what the Barita Foundation is doing. He deserves a national honour for what he has been able to achieve. He is a good example for young people in the financial sector and is held up as to what they can achieve. He is a patriot and contributes to Jamaica. He gives back to communities and gives young people opportunities.”

William Mahfood, chairman of the Wisynco Group and chairman of the Mona School of Business: “I am always amazed at Paul’s entrepreneurial skills and what he has been able to achieve in his career.”

Comments