The investment house Stocks and Securities Ltd (SSL) is very much in the news with allegations of widespread fraud and issues of capital adequacy concentrating the minds of those who hold money in Jamaican financial institutions.

Swift moves have been made to allay fears and to ensure confidence in the country’s financial system does not evaporate.

The credibility of investment bankers is now placed under suspicion with calls to keep a closer eye on how they conduct their business, always seeing to it that investors’ money remains safe and secure.

It shouldn’t be the case that all have to suffer for the lax practices of one investment house.

The audit report of SSL affiliate, SSL Venture Capital, is instructive and demonstrates the need to pay attention to early warning signs and red flags.

An independent Auditors Report by Bakertilly of Cargil Avenue in Kingston reads: “We draw attention to Note 2 (c) in the financial statements which indicates that the Group and the Company as at 30 June 2022 has accumulated deficit of $147,491,795 (2021: $160,625,201) and $118,230,325 (2021: $123,458,135) respectively. Further, as at 30 June 2022, the Group’s and the Company’s current liabilities exceeded its current assets by $51,327,019 (2021:$73,204,580 and $7,214,500 (2021: $13,170, 551), respectively.

“Continuation as a going concern, therefore, may be in doubt and is dependent on obtaining continued financial support. No adjustments have been made in the financial statements for any effects this might have on the carrying values of assets and liabilities as at the reporting date.

“The Group and Company remains dependent on their ultimate parent (MFS Acquisition Limited) for continued financial report.

SEVERAL QUESTIONS YET TO BE ADDRESSED

A distinction must be made here between SSL and SSL Venture Capital. They are two separately run vehicles.

Questions have been asked of SSL’s executive management team and board of directors during the period in which investors’ accounts were raided. What did they know and when were they aware of the precarious situation in which the Hugh Croskery-founded company found itself? These questions are yet to be addressed.

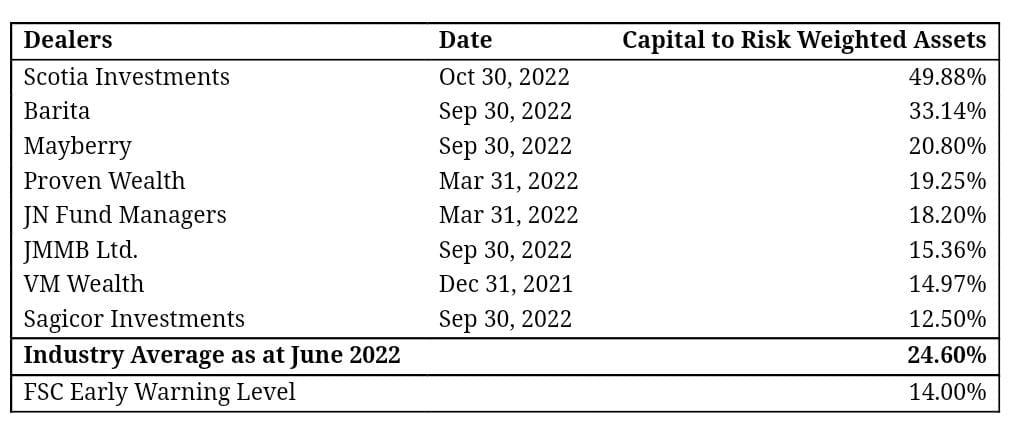

Then there is the question of capital adequacy of SSL and how does it stack up against other investment houses in Jamaica?

Take a look at the table below:

Comments