For some individuals, having three mortgages while managing the demands of adulthood would spell financial disaster. However, for Jody McLean*, a 43-year-old full-time nurse and mother, it became the foundation of a new future.

By strategically investing in real estate over the last 14 years, while juggling hospital shifts and parenting, she has managed to create multiple income streams and take control of her family’s financial destiny.

“Two of my homes are already generating income,” she said, outlining a strategy built on long-term rentals. Each property, financed through JN Bank, carries its own mortgage, but she explained that the rental income offsets much of the monthly expense, turning what many would view as a burden into a calculated investment.

“I’m breaking even right now,” she said. “This is a long-term investment for me. It’s part of my retirement plan because one day I want to be on a beach, relaxing and hear that notification on my phone letting me know the rent has been paid. By then, the mortgages will be paid off.”

“It’s very important for me to even know that if anything happened and I’m not here, at least they [my family] can sell one of the houses to finance my son, who’s now five, through college when that time comes and for him to continue his life,” she added.

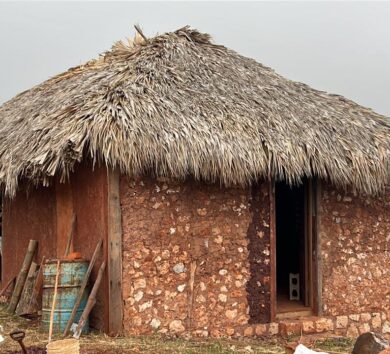

All of Ms McLean’s three homes are located in St Catherine, with the first purchased in 2011. That house was brand new. She purchased the second property, a fixer-upper, in 2016 and then used the equity from the first two homes to acquire the third one in 2019.

Currently, she is working with JN Bank to expand the third property using an additional loan facility. The planned improvements, she said, are intended to further strengthen her long-term investment strategy, ensuring that the property will also contribute to her overall portfolio.

“The plan is to live in the addition and rent the original piece [of the home],” she shared.

Reflecting on her upbringing in a family that “had what we needed,” Ms McLean said the decision to buy her first home was fuelled by a situation she witnessed at work.

“What helped to drive my decision in getting a house was when I was working at an institution, there was a man there who dedicated his life to his job and seemed to have had his life together, but he lost his job and had nothing at all- no house. When I realised that, it took a toll on me mentally, and I said I never want to get to that age and have nothing to fall back on, so I pushed myself and got that first house.”

Now at three properties, she said, “If I can get more, I will,” with plans to act on that goal in the near future.

She said although she has made sacrifices over the last decade, including selling her car and having several side hustles, to get to the position she is in today, having the right financial partner helped her achieve her goals.

“Buyer’s remorse is real. After you purchase a house, the first one and a half years after, you feel like, ‘why’d I do this’. It’s a financial adjustment. But JN sees the bigger picture, and they are always willing to help,” she said.

“I had some issues with the bank at one point, and we had a conversation and smoothed it out. They’re always open to talk and I think JN is dedicated to helping persons. It’s never a cold shoulder but always an ‘I’ll work with you’ approach,” she added.

Emphasising that homeownership demands focus and commitment, she advised anyone pursuing it to recognise that the journey is neither quick nor easy. She also urged prospective buyers not to wait for the “perfect” house and to be ready to make adjustments along the way.

“It’s a strategy; putting pen to paper and knowing what you’re doing,” she said, recommending prospective homeowners to also save for related fees and consult financial advisors early in the process.

Comments