Durrant Pate/Contributor

Victoria Mutual Investments Limited (VMIL), which felt the pinch from the COVID-19 pandemic, has entered a period of growth and plans to diversify revenues whilst exploiting mergers and acquisitions in 2023 and the foreseeable future.

The company saw a 57 per cent rise in net surplus in 2022, a 28 per cent hike in revenues, a 20.24 per cent increase in return on equity, and a 17.59 per cent improvement in its capital adequacy, and is aiming to do even better in 2023.

Shareholders attending yesterday’s (June 9) annual general meeting applauded this news, as the management reeled off the financial highlights for 2022 and the strategy for attaining more profitability in 2023 and the foreseeable future.

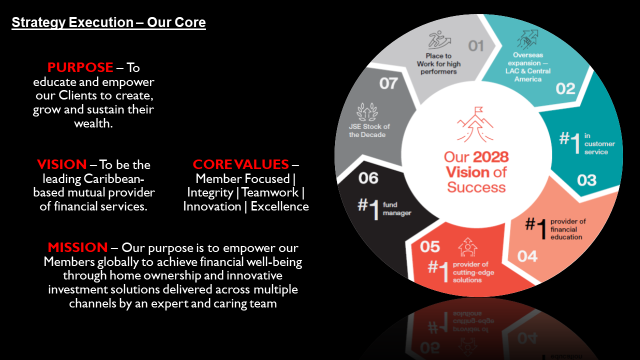

Rez Burchenson, chief executive at VM Investments Limited, articulating the growth strategy for 2023 and beyond, noted that it is predicated on growing revenues lines and off-balance sheet assets, accelerating digitisation and automation as well as increased sales productivity.

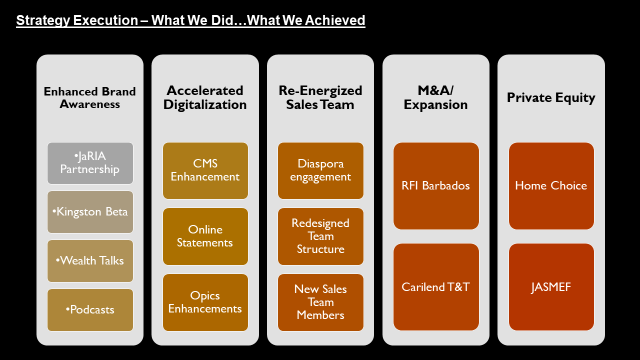

Burchenson also spoke about VMIL’s strategy execution focusing on what was done and results from the strategy execution.

Strategy execution

Financial performance

Brian Frazer, deputy CEO, presented the year-over-year financial performance showing the extent of the growth exhibited in 2022 while managing business risks, which was a challenging task for VMIL, the investment arm of the VM Group.

VMIL chairman, Michael McMorris, described the 2022 performance as solid making reference of the economic context in which the positive performance was attained with inflation projected to have peaked at a 70-year high of 8.80 per cent and an aggressive monetary policies adopted by the Central Bank.

He mentioned certain acquisitions made by VMIL last year such as the 10 per cent stake in Home Choice Enterprise, a food-manufacturing company, which was done, ”in keeping with VMIL’s mission to empower businesses for transformational growth.” VMIL in 2022 also partnered with London-based Actus Partners, completing the first closing of a new Caribbean private equity fund focused on small and medium enterprises.

McMorris cited the 2021 deal with Republic Bank (Barbados) Limited to acquire 100 per cent shareholding in Republic Funds (Barbados) Inc. He told shareholders that all required regulatory approvals expected in time for VMIL to assume ownership control in 2023.

He highlighted VMIL’s role as arranger for Dolla Financial’s J$500 million initial public offer (IPO), which is one of the largest in history of Junior Market of the Jamaica Stock Exchange (JSE), where it was oversubscribed by 950 per cent.

Comments